Mastering Competition Analysis: Your Ultimate Guide to the Competition Analysis Matrix

- Date

Trying to get ahead in business means you really need to know who you’re up against. That’s where looking at your competition comes in. It’s not just about seeing what other companies are doing, but really understanding their moves, their good points, and their not-so-good points. This guide is all about breaking down how to do that, especially using a competition analysis matrix. It’s a tool that helps you see everything clearly so you can make smarter decisions and give your business a real boost.

Key Takeaways

- Knowing your competition helps you find opportunities and avoid mistakes.

- You can find competitors using search engines, social media, and industry reports.

- Creating profiles and analyzing competitors involves looking at their company, products, and customers.

- A competition analysis matrix is a great way to compare your business to others visually.

- Understanding competitor strengths and weaknesses helps you figure out your own unique advantage.

Understanding the Importance of Competition Analysis

So, why bother with all this competitor research? It’s not just about knowing who else is out there; it’s about understanding the whole game. Knowing your competition is like having a map before you start a journey. Without it, you’re just guessing where to go, and honestly, that’s a recipe for getting lost. Think about it: if you don’t know what others are doing, how can you possibly figure out what makes you special? It helps you see where the gaps are, the places where customers aren’t quite getting what they need. Plus, it gives you a reality check on your own business. Are you really as good as you think you are in certain areas? Or are you falling behind? This kind of honest look helps you make smarter choices about where to put your energy and resources. It’s not about copying them, but about learning from their successes and, maybe more importantly, their failures. This way, you can avoid making the same mistakes and find your own path to success. It’s a big part of figuring out your unique selling point, that thing that makes customers choose you over everyone else. We all want our businesses to grow, right? Well, understanding the competitive landscape is a pretty big piece of that puzzle. It’s how you find those opportunities to stand out and actually get ahead. It’s about being smart, not just busy. You can find out more about why this is so important on this page about competitive analysis .

Methods for Identifying Your Business Rivals

So, you’ve got a business idea, and you’re ready to take on the world. But wait, who else is already out there doing something similar? Figuring out who your competition is forms the bedrock of any smart business plan. It’s not just about knowing the big names; it’s about understanding the whole landscape. Ignoring your rivals is like trying to win a race with your eyes closed. Let’s break down how to find them.

Leveraging Search Engines for Competitor Discovery

This is probably the most straightforward way to start. Think about the terms someone would type into Google if they were looking for what you offer. Use those keywords. See who pops up on the first page, and maybe the second. These are your likely direct competitors. Don’t just look at the ads, though; pay attention to the organic results too. Also, try searching for problems your product or service solves. Sometimes, companies that aren’t an exact match but address a similar customer need can also be important to know about. It’s about finding anyone vying for your potential customer’s attention and wallet.

Utilizing Social Media for Competitor Identification

Social media is a goldmine for this. What platforms does your target audience hang out on? Go there. Search for relevant hashtags, industry terms, and even your own brand name. See which companies are actively posting, engaging with users, and building a following. Look at who people are talking about, who they’re tagging, and who’s getting a lot of comments or shares. You can also check out competitor pages directly to see their content strategy and how they interact with their customers. It gives you a feel for their brand personality and how they connect with people. You might even find smaller, niche players that a quick Google search misses. Checking out review sites like Trustpilot or G2 can also show you who customers are comparing solutions against.

Exploring Industry Reports and Research

This is where you get a bit more formal. Industry reports, market research studies, and even trade publications can offer a bird’s-eye view of your market. They often list key players, market share data, and emerging trends. While these might cost money, many industry associations or business libraries offer access. You can also find summaries or articles that cite these reports online. These sources can help you identify both established companies and newer entrants you might not have found otherwise. It’s a good way to get a broader perspective and understand the overall market structure. If you’re trying to find your niche, understanding who else is serving that space is key finding your niche .

Identifying your competition isn’t a one-time task. The market shifts, new players emerge, and existing ones change their strategies. Make it a habit to revisit this research regularly to stay informed and adapt your own approach accordingly.

Deep Dive into Competitor Profiling

Once you’ve got a handle on who your competition actually is, the next logical step is to really get to know them. This isn’t just about knowing their name; it’s about building a detailed picture of their operations, their market approach, and what makes them tick. Creating thorough competitor profiles is the bedrock of effective analysis. It helps you see where you stand and where the opportunities lie.

Creating Essential Competitor Profiles

Start by gathering the basics. Think of this as building a digital dossier for each rival. You’ll want to note down:

- Company Name: The obvious starting point.

- Website URL: Where to find them online.

- Primary Business Focus: What do they really do?

- Estimated Size: Number of employees or revenue range, if you can find it.

- Location: Where are they based?

This initial data gives you a framework. It’s like sketching out the main characters before you write the story.

Analyzing Competitor Company Overviews

Now, let’s dig a bit deeper into the company itself. What’s their story? Look into:

- Founding Date & History: How long have they been around?

- Mission & Values: What drives them? What do they stand for?

- Leadership Team: Who’s at the helm?

- Recent News & Press Releases: What are they talking about publicly?

Understanding their background can reveal a lot about their long-term strategy and company culture. It helps you understand their why .

Examining Product and Service Offerings

This is where you get into the nitty-gritty of what they actually sell. For each competitor, list out:

- Key Products/Services: What are their main offerings?

- Features & Benefits: What makes their products stand out?

- Pricing Structure: How do they price their goods or services? Are there different tiers?

- Unique Selling Proposition (USP): What’s their main hook?

Comparing these details side-by-side can highlight areas where you might be stronger or weaker. For instance, you might find that while a competitor has a similar product, their pricing is significantly higher, which could be an advantage for you. Or maybe their features are more advanced, giving you something to aim for. You can use a simple table to keep this organized:

| Feature/Service | Competitor A | Competitor B | Your Business |

|---|---|---|---|

| Product X | High-end | Mid-range | Mid-range |

| Pricing Tier 1 | $50 | $40 | $45 |

| Key Differentiator | Advanced Tech | Lower Price | User-Friendly Interface |

Understanding Target Market Demographics

Who are they trying to reach? This is super important. Try to figure out:

- Primary Target Audience: Who are their ideal customers?

- Demographics: Age, gender, location, income level, education.

- Psychographics: Interests, values, lifestyle, pain points.

- Customer Reviews: What are customers saying about them on sites like G2 or Capterra? This can be a goldmine for understanding customer sentiment and identifying unmet needs. Analyzing these reviews can give you a real sense of their customer base and how they’re perceived in the market.

Knowing your competitors’ audience helps you refine your own marketing efforts and identify potential gaps in the market. If a competitor is heavily targeting one demographic, maybe there’s an underserved segment you can focus on. It’s all about finding your own space to shine. You can find a lot of this information by looking at their website’s ‘About Us’ page, their social media content, and even job postings, which can hint at the skills they value in their team and, by extension, their customers. Effective keyword research is also a good way to understand what terms their audience is searching for [0c03].

Conducting an In-Depth Competitor Analysis

Once you’ve got a handle on who your competitors are, the next step is to really dig into what they’re doing. This isn’t just about glancing at their website; it’s about a thorough examination of their business operations and market approach. Understanding their trajectory and market position is key to finding your own path to success.

Researching Growth and Market Share

To get a feel for how a competitor is doing, look at their growth trends and how much of the market they’ve captured. Are they expanding rapidly, or have they plateaued? This information can often be found in industry reports or sometimes hinted at in their own press releases. It helps you see where they stand and if they’re a major player you need to worry about.

Evaluating Marketing Strategies and Positioning

What’s their message? How are they trying to reach customers? This involves looking at their advertising, their social media campaigns, and how they talk about their products or services. Are they positioning themselves as the budget option, the luxury choice, or something else entirely? Understanding their marketing helps you see how they’re trying to win over customers.

Assessing Customer Psychographics

Beyond just demographics (like age and location), try to understand the mindset of their customers. What motivates them? What are their values and interests? This is a bit trickier to nail down, but you can often get clues from the language they use in their marketing, the types of content they share, and the communities they engage with online. It’s about understanding the ‘why’ behind their customer loyalty.

Forecasting Market Changes and Reactions

Based on what you’ve learned about your competitors and the broader market, try to predict what might happen next. Will a competitor launch a new product? How might they react if you change your pricing? Thinking ahead like this allows you to be proactive rather than just reactive. It’s like playing chess; you want to think a few moves ahead. You can start by looking at how they’ve responded to changes in the past. For instance, if a competitor saw a dip in sales, did they immediately slash prices, or did they invest more in advertising? Observing these patterns can give you a good idea of their likely future actions. This kind of foresight is invaluable for making informed business decisions .

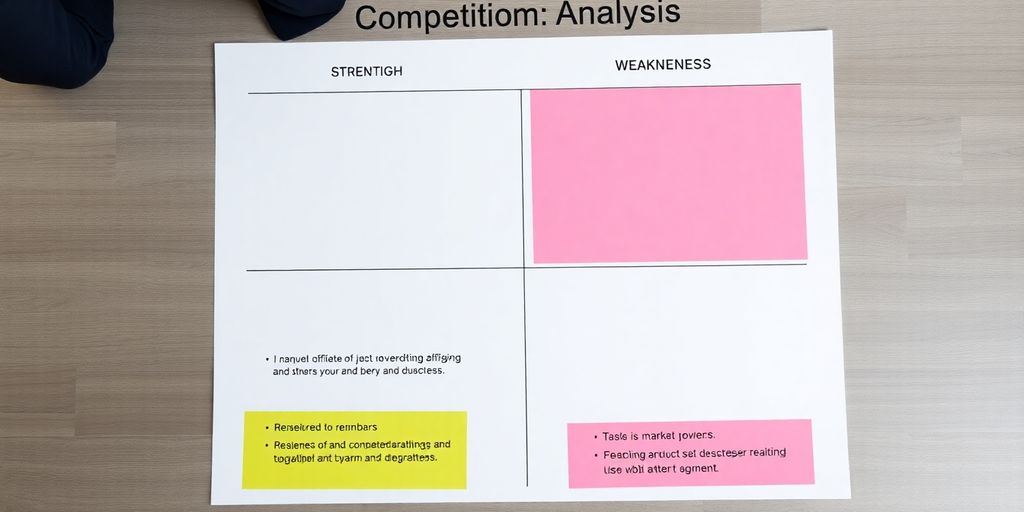

Building Your Competition Analysis Matrix

So, you’ve done the legwork, identified your rivals, and gathered a mountain of data. Now what? It’s time to make sense of it all by building your competition analysis matrix. Think of this matrix as your command center, a place where all those scattered facts come together in a clear, organized way. It’s not just about listing who’s out there; it’s about seeing how you stack up against them on the important stuff.

Visualizing Findings with a Competitive Matrix

This is where the magic happens. You take all the information you’ve collected – pricing, features, marketing tactics, customer reviews – and put it into a structured format. A simple spreadsheet, like one made in Google Sheets or Excel, works wonders. You’ll have your competitors listed down one side and the key factors you’re comparing across the top. This visual layout makes it incredibly easy to spot patterns and differences at a glance. It’s like looking at a map of the competitive landscape; you can see where everyone is positioned.

Comparing Key Business Factors Objectively

When you’re filling out your matrix, try to be as objective as possible. Instead of saying ‘Competitor X has great customer service,’ try to find evidence. Maybe they have a much higher rating on review sites, or their response times are consistently faster. You’re looking at things like:

- Product quality and features

- Pricing strategies

- Marketing messages and channels

- Customer service reputation

- Website user experience

- Social media engagement

It’s about comparing apples to apples, or at least trying to. This objective comparison helps you see where your business truly shines and where it might be falling short. For instance, you might find that while a competitor has a lower price, your product offers significantly more durability, which is a key factor for a certain customer segment. Understanding these trade-offs is key to strategic positioning .

Categorizing Competitors by Relevance and Threat

Not all competitors are created equal, right? Some are direct rivals who are constantly nipping at your heels, while others might be smaller players or in adjacent markets. Your matrix should help you sort them. You can create categories like ‘High Threat/High Relevance,’ ‘Low Threat/High Relevance,’ ‘High Threat/Low Relevance,’ and ‘Low Threat/Low Relevance.’ This helps you focus your energy. The ‘High Threat/High Relevance’ group? They need your immediate attention and deep analysis. The ‘Low Threat/Low Relevance’ ones? You can probably just keep an eye on them from a distance. This sorting process ensures you’re not wasting time on competitors who don’t really impact your business.

Analyzing Competitor Strengths and Weaknesses

Once you’ve got a handle on who your competitors are and what they’re up to, the next logical step is to really dig into what makes them tick – specifically, their strengths and weaknesses. This isn’t just about listing things; it’s about understanding the ‘why’ behind their success or struggles. Think of it like this: if you’re trying to get better at a sport, you don’t just watch the other players; you analyze their moves, their training, and what they do well (or not so well).

Evaluating Competitor Content and Messaging

Competitors’ content and how they talk about themselves tells you a lot. Are they putting out blog posts, videos, or social media updates? What’s the quality like? Is it informative, engaging, or just fluff? We need to look at their main message – what are they promising customers? Is it consistent across all their platforms? Sometimes, a competitor might have a great product but a confusing message, or vice versa. It’s also worth checking out their social media presence. How many followers do they have? Are people actually interacting with their posts, or is it just crickets? High engagement usually means they’re hitting the right notes with their audience. You can track things like follower growth and how many likes, comments, and shares their posts get. This gives you a good idea of what’s working for them.

Assessing Organic Traffic and Backlink Profiles

Now, let’s talk about the digital footprint. How much traffic are competitors getting from search engines, and where is it coming from? Tools can help us see which keywords they rank for and how much traffic those keywords bring in. A strong organic traffic number often points to good SEO and content. Then there are backlinks – those links from other websites pointing to theirs. A lot of high-quality backlinks can mean a site is seen as authoritative and trustworthy. We should look at both the quantity and the quality of these links. Are they coming from reputable sites, or are they spammy? This can reveal a lot about their off-page SEO efforts and overall online authority. For example, a competitor with a lot of links from major industry publications likely has a strong outreach strategy.

Examining Technical SEO Performance

Beyond content and links, the technical side of a competitor’s website matters too. Is their site fast? Does it work well on phones? These are basic but important factors. Slow websites or sites that aren’t mobile-friendly can really hurt a business, no matter how good their products are. We can use tools to check things like site speed, mobile usability, and whether they have a proper sitemap. A competitor that nails its technical SEO is making it easier for search engines to find and rank their pages, which usually translates to more organic traffic. It’s a behind-the-scenes thing, but it’s definitely a strength if done right. Understanding these technical aspects helps paint a fuller picture of their online presence and potential advantages.

Analyzing these different areas helps us build a clear picture of where each competitor stands. It’s not just about finding their weak spots, but also recognizing what they do exceptionally well. This insight is what we’ll use to figure out our own unique advantages and how we can stand out in the market. It’s about learning from everyone, the good and the not-so-good, to make our own strategy stronger. For anyone looking to grow an e-commerce business, understanding these competitive dynamics is key to finding your niche and improving your user experience.

Here’s a quick look at some key metrics to keep an eye on:

- Keyword Rankings: Where do they show up for important search terms?

- Organic Traffic: How much traffic are they getting from search engines, and is it growing?

- Backlink Profile: How many links point to their site, and are they from good sources?

- Technical SEO: How well is their website built from a technical standpoint (speed, mobile-friendliness)?

By systematically looking at these elements for each competitor, you start to see patterns and identify areas where you can either compete directly or find a different angle altogether. It’s a bit like detective work, piecing together clues to understand the bigger picture of the market.

Leveraging Competitive Insights for Strategic Advantage

So, you’ve done the legwork, built your matrix, and figured out who’s who and what they’re up to. Now what? It’s time to actually use all that info to make your business smarter and stronger. Think of it like this: you wouldn’t go into a game without knowing the other team’s playbook, right? This is the same idea, but for your business. It’s about taking what you’ve learned and turning it into real action that helps you stand out.

Identifying Your Unique Competitive Advantage

After looking at everyone else, it’s easier to see what makes you different. Maybe your competitors are all about flashy marketing, but you offer something more personal. Or perhaps they focus on a broad audience, and you’ve found a specific group they’re not really serving well. Pinpointing this unique edge is key. It’s what you’ll build your messaging around and how you’ll attract customers who are looking for exactly what you do best. Don’t just guess; use your analysis to find concrete proof of your special something.

Discovering Underserved Audiences and Niches

Sometimes, you’ll notice that even big players miss the mark with certain customer groups. Maybe a competitor’s product is too complicated for beginners, or their pricing is out of reach for a particular segment. These are your opportunities. By spotting these gaps, you can tailor your products, services, or marketing to appeal directly to these overlooked customers. It’s a smart way to grow without directly fighting giants on their own turf. Finding these underserved groups can really change your business direction.

Staying Ahead of Industry Trends

Your competitors are often the first to try new things, whether it’s a new marketing channel, a different pricing model, or a new feature. By watching them, you get an early heads-up on what’s working and what’s not in your industry. This lets you adapt faster. If you see a competitor getting a lot of traction with video content, it might be time for you to explore that too. Or if they’re struggling with a new software update, you know to be cautious. It’s about learning from their experiments, both the successes and the failures, so you don’t have to make the same mistakes. Keeping an eye on industry shifts helps you stay relevant.

Refining Your Business Strategy

Ultimately, all this analysis feeds back into your own business plan. You can adjust your pricing, tweak your product features, or change how you talk about your brand based on what you’ve learned. For example, if you see that a competitor’s customer service is a major pain point for their users, you can make sure your support is top-notch and highlight that in your own marketing. It’s about making informed decisions that give you a better shot at success. This continuous improvement is what keeps a business competitive over the long haul. You can even use this information to improve your e-commerce store management .

Making sense of competitor data isn’t just about knowing what others are doing; it’s about understanding how their actions and strategies create opportunities or challenges for your own business. Use these insights to make your next move a calculated one, rather than a shot in the dark. It’s about being proactive, not just reactive.

Putting It All Together

So, we’ve walked through how to really look at what your competition is up to. It’s not just about knowing their names, but understanding what they do well, where they fall short, and how they talk to customers. Using tools and a clear plan helps make this whole process less of a headache. Remember, this isn’t a one-and-done thing; keeping an eye on the market and your rivals means you can adjust your own game. By doing this regularly, you’ll be in a much better spot to make smart moves and stand out.

Frequently Asked Questions

What is competitor analysis and why should I care?

Think of competitor analysis as checking out what other businesses similar to yours are doing. It’s like seeing what games other kids are playing so you know how to play better yourself. You look at what they sell, how they tell people about it, and who they sell to. This helps you figure out what makes your business special and how you can do even better.

How do I find out who my competitors are?

You can find competitors by simply searching online for things related to your business. Think about what words customers would use to find you. Also, check out social media sites to see which businesses are talking to the same people you want to reach. Looking at reports about your industry can also show you who else is in the game.

What’s the best way to learn about my competitors?

First, make a list of businesses that are like yours. Then, for each one, try to find out what they offer, who their customers are, and how they advertise. It’s like making a trading card for each competitor, listing their strengths and weaknesses. This helps you see where you fit in.

What is a competition analysis matrix?

A competition analysis matrix is like a chart or a table that helps you compare your business to others side-by-side. You list important things like price, quality, or customer service, and then fill in how each competitor does in those areas. This makes it easy to see who’s good at what and where you can improve.

How do I find my business’s special advantage?

You figure out what makes your business stand out from the rest. Maybe you have a better product, offer friendlier service, or have a lower price. This special something is your advantage. Knowing this helps you tell customers why they should choose you instead of someone else.

How often should I check on my competitors?

It’s a good idea to look at your competitors every few months, maybe every three months. If your industry changes really fast, you might even want to check in more often, like once a month. This way, you always know what’s new and can make smart changes to your own business plan.